Unlocking Value from Interest Rate Cuts | Diversified ETF-Only - 09/24/24

Portfolio Adjustments

Conservative

Current Stock Exposure is 33.5%

Benchmark Stock Exposure is 30%

Sell All: JP Morgan Ultra-Short Income ETF (JPST)

Sell Half: -2.5%, iShares Edge MSCI USA Quality Factor ETF (QUAL)

Add to Current Fund: +2% Hartford Strategic Income (HSNIX) & +2.5% Schwab US Dividend Equity ETF (SCHD)

Moderate

Current stock exposure is 69.5%

Benchmark stock exposure is 60%.

Sell Half: -3.5%, iShares Edge MSCI USA Quality Factor ETF (QUAL)

Add to Current Fund: +3.5% Schwab US Dividend Equity ETF (SCHD)

Aggressive

Current Stock Exposure is 95%

Benchmark Stock Exposure is 85%

Sell Half: -5%, iShares Edge MSCI USA Quality Factor ETF (QUAL)

Add New Fund: +5% Schwab US Dividend Equity ETF (SCHD)

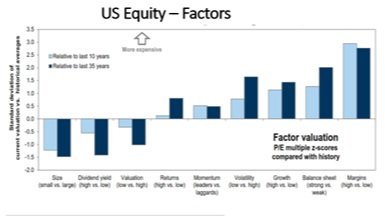

Last week, the Federal Reserve lowered interest rates by 50 basis points (0.5%), and we see this as just the start of their rate-cutting cycle. In response, the investment committee decided to increase our portfolio's exposure to dividend-paying stocks. As illustrated in the chart above, these stocks are currently undervalued compared to their historical averages over the past 35 years.

Source: Compustat, FactSet, I/B/E/S, and Goldman Sachs Global Investment Research

With a track record of strong performance following interest rate cuts and appealing valuations, we chose to reduce our position in a fund that is more exposed to categories deemed overvalued and reallocate those funds to a dividend-focused investment (Schwab US Dividend Equity ETF).

In our conservative portfolio, we made an additional trade in light of the Fed's decision to cut rates. The investment committee aimed to increase the duration of our bond portfolio. One advantage of extending bond duration is that it allows investors the opportunity to secure higher yields from existing bonds before rates decline further, thereby enhancing the overall income of the portfolio.

To accomplish this, we sold our entire position in the JPMorgan Ultra-Short Income ETF, which specializes in short-term investments and added to our existing holding in the Hartford Strategic Income fund, which contains higher-duration investments.

Charles Schwab sent you a trade confirmation with the exact trades we placed in your portfolio. Please let us know if you would like to review these trades or your portfolio.

-SCM Investment Committee