Maximize Your Retirement Savings: Mega Back Door Roth Conversions

If you have extra funds available for retirement, a Mega Backdoor Roth conversion is an excellent way to grow your savings tax-free. This strategy allows individuals to make "after-tax" contributions to their 401(k) or 403(b) beyond the usual contribution limits, which can then be converted into a Roth account tax-free. It’s especially beneficial for high-income earners who have already hit the contribution limits for their retirement accounts and are ineligible for direct Roth IRA contributions due to income restrictions. The Mega Backdoor Roth Conversion allows you to bypass these limits, offering the opportunity for tax-free growth on your retirement savings.

To fully understand Mega Backdoor Roth Conversion, it's important to understand these two key components:

After-tax contributions

Roth conversions

After-Tax Contributions

After-tax contributions are a unique feature of employer-sponsored retirement plans, allowing you to contribute money that has already been taxed. These contributions can be made once you've reached the standard contribution limit, which for 2025 is $23,500 for those under 50 and $31,000 for those 50 or older. For example, if a 45-year-old employee contributes $23,500 to their retirement plan and their employer provides a $5,000 matching contribution, they could contribute an additional $41,500 to their account, provided their retirement plan allows after-tax contributions. I cover this in more detail in the “Contribution Limits and Guidelines” section below.

Roth-Conversion

A Roth conversion involves transferring funds from a traditional retirement account, such as a 401(k), 403(b), or IRA, into a Roth account, enabling the funds to grow and be withdrawn tax-free in retirement.

Once you've made after-tax contributions to your retirement plan, you can transfer these funds to a Roth account through a Roth conversion.

How to execute the conversion:

In-plan conversion: You can convert after-tax funds to a Roth within your retirement plan as soon as they are deposited, which is the recommended approach.

In-service withdrawal: If your plan doesn’t offer in-plan conversions, you may be able to use an "in-service withdrawal" to move your after-tax contributions to a Roth IRA, while transferring any market gains to a traditional IRA. Be sure to consult your plan administrator to determine which options are available to you.

To maximize tax-free growth, it's recommended to convert these funds right away. Waiting to convert them will result in any gains being moved to a pre-tax account, where they will grow tax-deferred but will be taxed at income tax rates when withdrawn.

Contribution Limit and Guidelines

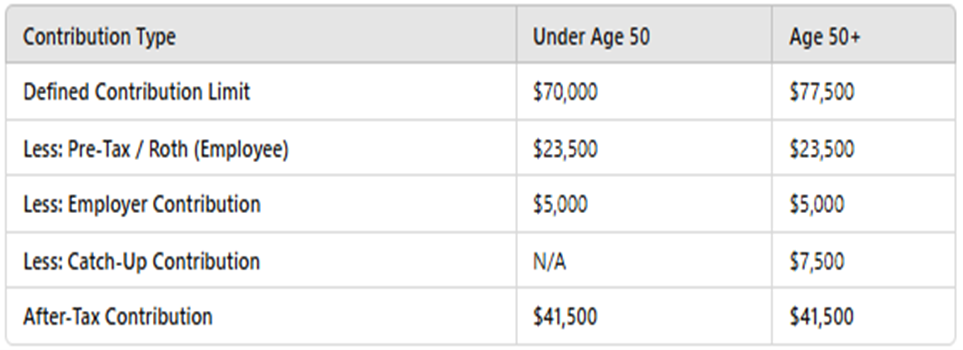

Defined Contribution Limit: The IRS sets annual contribution limits for defined contribution plans (for example: 401(k) or 403(b) plans). In 2025, the total contribution limit is $70,000 ($77,500 for those age 50 and older), which covers employee elective deferrals (pre-tax, Roth, and after-tax contributions), employer matches, and other contributions.

After-Tax Contribution Limits: After-tax contributions are subject to the same overall limit. However, once pre-tax and/or Roth contributions reach their respective limits ($23,500, for those under age 50 and $31,000 for those over age 50 in 2025), individuals can contribute additional funds on an after-tax basis, up to the total limit.

In summary, calculating your contribution to an "after-tax" account involves subtracting the "defined contribution limit" from the total contributions made to your account, including both your contributions and those from your employer.

Note: The Employer Contribution figure is hypothetical. Please consult your company’s HR team for details about your employer's matching contributions.

Benefits of the Mega Back Door Roth Conversion

The main advantage is the Roth component. A Roth account, whether a Roth IRA, Roth 401(k) or Roth 403(b), provides several key benefits:

Tax-Free Withdrawals: You can make tax-free withdrawals from your Roth account, provided you meet certain conditions (e.g., being at least 59½ years old and having the account for at least five years). This offers predictability and flexibility in retirement planning.

No Required Minimum Distributions (RMDs): Roth accounts do not require RMDs during the account holder’s lifetime, unlike traditional IRAs, 403(b)s or 401(k)s. This means you can leave the money in the account to continue growing as long as you want.

Flexibility in Retirement: Since withdrawals from a Roth account are tax-free, they provide flexibility in managing your income and tax liability in retirement. This can help you avoid moving into a higher tax bracket during retirement.

Estate Planning Benefits: Roth accounts are excellent tools for leaving wealth to heirs. When beneficiaries inherit a Roth account, they don’t have to pay income tax on withdrawals, which helps preserve more of the inherited wealth.

Conclusion

In summary, the "Mega Backdoor Roth contribution" enables you to move after-tax funds into a Roth account, helping your money grow with the benefits outlined above. Not all retirement plans offer after-tax contributions, but if yours does and you're looking to increase your retirement savings, this strategy is worth considering. If you're unsure whether after-tax contributions are the right move for you, we encourage you to contact our office for a more detailed discussion.