Market Update: Tariffs and Recent Volatility

What Happened

On April 2nd, President Trump announced sweeping tariffs on all imported goods. The policy includes a baseline 10% tariff on all imports, along with additional reciprocal tariffs targeting key trading partners — 34% on China, 24% on Japan, and 20% on the European Union, among others.

Markets reacted sharply to the announcement. The S&P 500 fell 4.8% — its worst single-day performance since 2022. The Dow Jones dropped 3.98%, and the Nasdaq declined nearly 6%. However, not all assets suffered losses. Fixed income provided downside protection, with the Bloomberg Aggregate Bond Index rising 0.53% on Thursday. This highlights the value of diversification — investors with well-diversified portfolios fared better than those with concentrated positions.

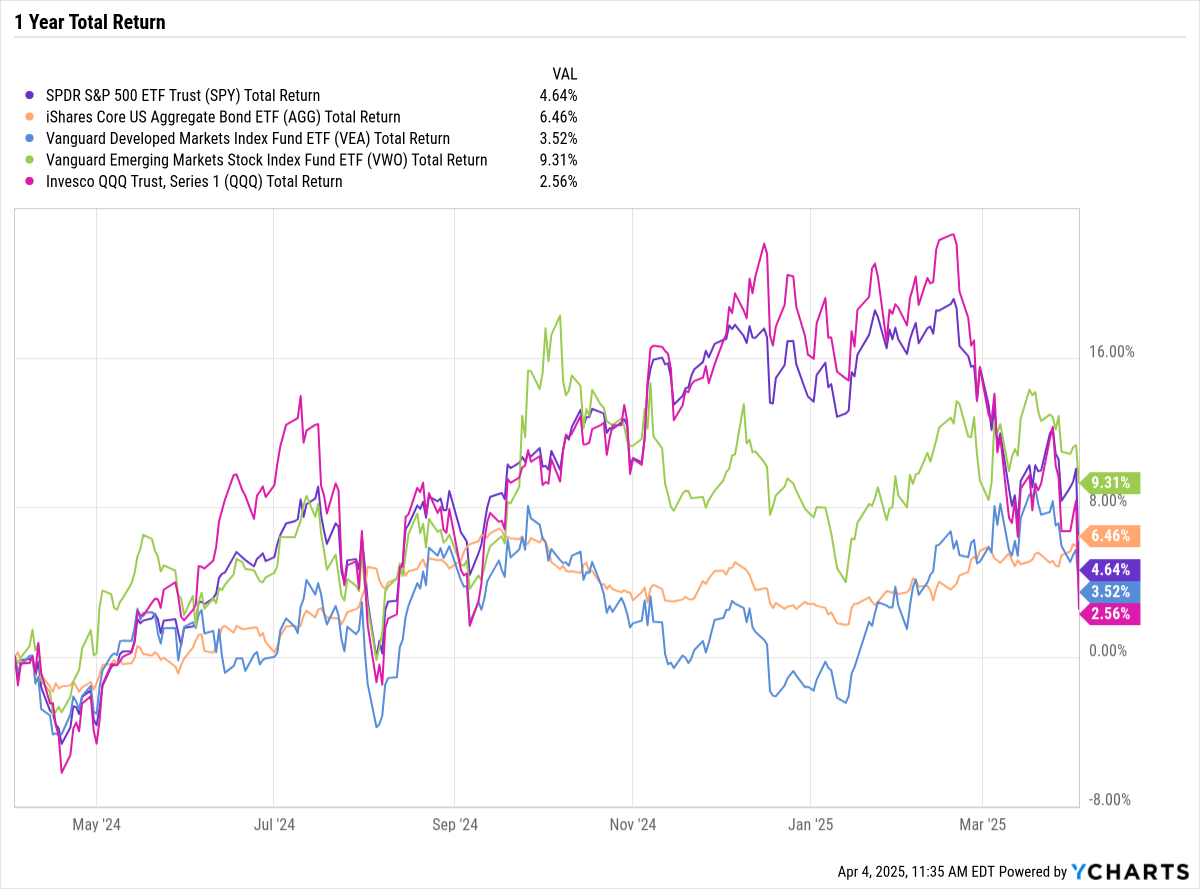

While such market moves can be unsettling, it’s important to maintain perspective. Even after the recent pullback, long-term investors continue to benefit from disciplined exposure to financial markets. The charts below illustrate returns of major asset classes over the past 1 and 3 years, underscoring the importance of staying invested.

Chart 1: 1-Year Returns by Asset Class

Chart 2: 3-Year Returns by Asset Class

Looking Ahead

We expect continued volatility as the situation evolves. Diversification and maintaining a portfolio aligned with your long-term goals will remain essential. It’s too early to predict the final outcome — much can still change depending on how global trading partners respond, and how U.S. policymakers react. Congress may attempt to intervene through legislation or legal channels.

Importantly, the global economy remains resilient. While the probability of a recession has increased, it is far from certain.

As you know, we’ve already reduced risk in your portfolio twice in the past two months. We will continue monitoring developments closely and make adjustments based on data — not emotion — to ensure your portfolio is appropriately positioned.

If you’d like to discuss your portfolio or the market environment in more detail, we are here for you.